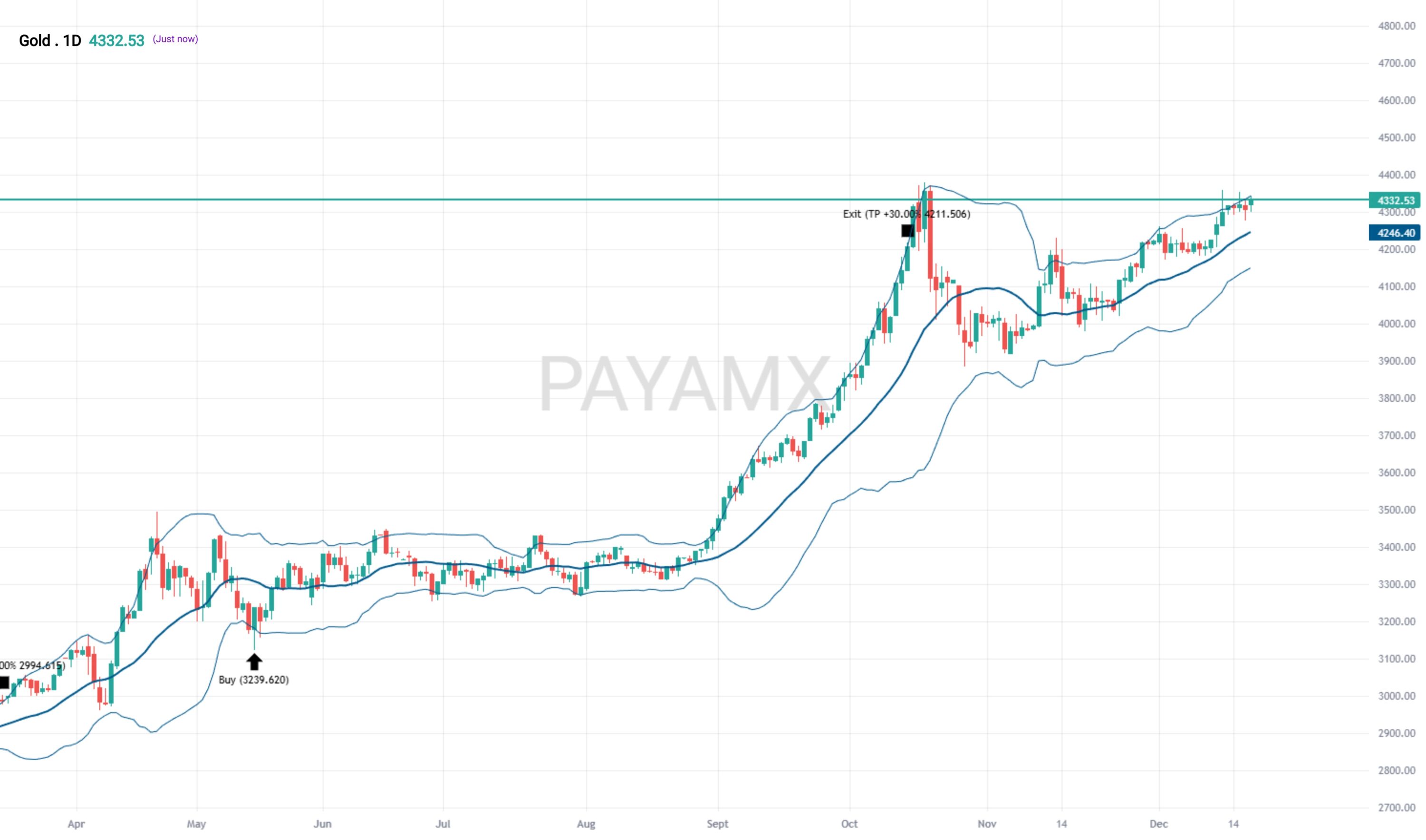

This PayamX long-only strategy combines volatility analysis with trend confirmation to identify structured bullish opportunities. It utilizes Bollinger Bands to assess price behavior relative to dynamic volatility boundaries, focusing on moments when price action shows recovery strength after interacting with lower volatility ranges. To ensure alignment with broader market direction, a long-term exponential moving average is used as a trend filter, allowing entries only when overall conditions favor upward movement.

The general approach seeks to capture rebounds within an established bullish environment, emphasizing disciplined timing rather than continuous exposure. Exit behavior is conceptually tied to changes in volatility conditions, allowing positions to be released if price action weakens back toward unfavorable zones. Risk management is embedded through predefined protective mechanisms, incorporating both stop-loss and take-profit concepts to manage downside risk while providing a clear framework for securing gains. The strategy reflects a balanced methodology that blends volatility awareness, trend alignment, and structured risk control.