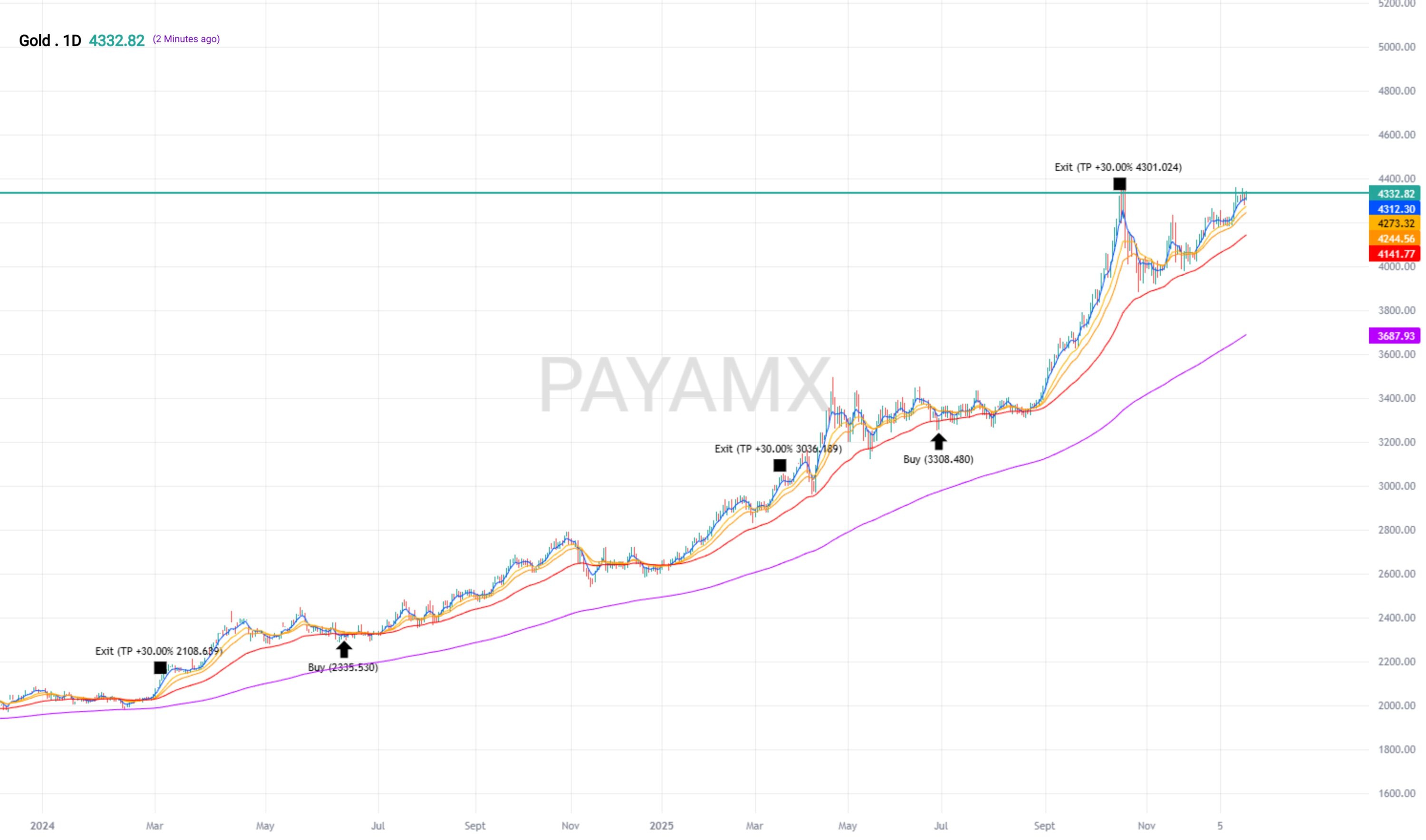

This PayamX long-only strategy leverages exponential moving averages as its primary analytical framework, combining a dynamic, adjustable period with a longer-term benchmark to assess trend direction. Conceptually, the strategy seeks to identify opportunities where price momentum aligns with the broader market trend, using the interaction between price and moving averages as a signal for potential entries. The approach emphasizes entering positions when shorter-term price movements show a clear upward trajectory above both a responsive moving average and a more stable, long-term reference, reflecting alignment with prevailing bullish conditions. Risk management is integrated at a conceptual level, with the strategy incorporating mechanisms to protect capital through predefined exit considerations that limit downside exposure while simultaneously providing a structured path for capturing favorable price movements. This design allows the strategy to balance disciplined entry signals with careful management of potential market fluctuations, maintaining a professional and trend-focused orientation.

Long EMA Strategy

This PayamX long-only strategy leverages exponential moving averages as its primary analytical framework, combining a dynamic, adjustable period with a longer-term benchmark to assess trend direction. Conceptually, the strategy seeks to identify opportunities where price momentum aligns with the broader market trend, using the interaction between price and moving averages as a signal for potential entries. The approach emphasizes entering positions when shorter-term price movements show a clear ...