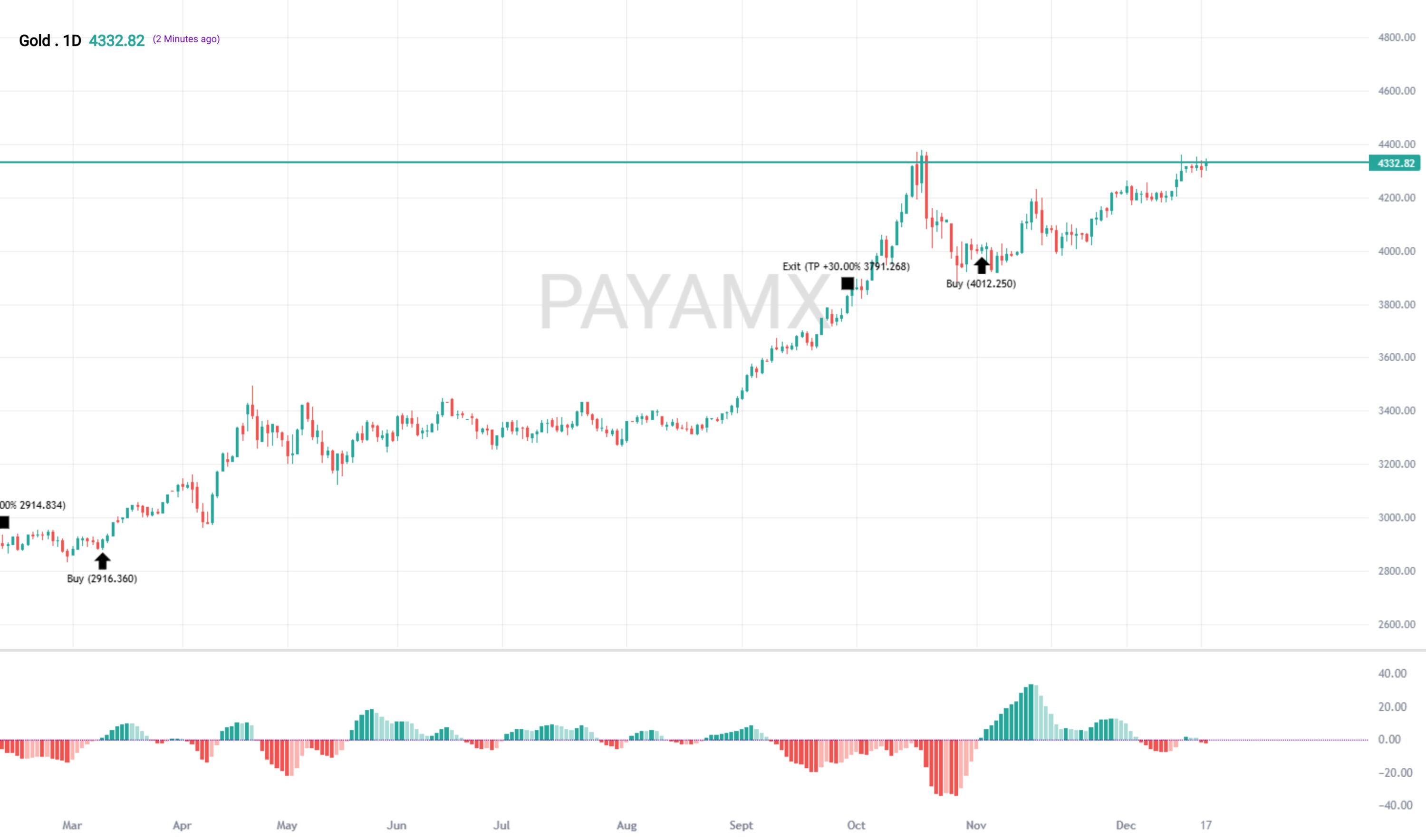

This PayamX long-only strategy leverages the MACD Histogram to identify shifts in market momentum, focusing on early signals of bullish strength. Conceptually, the histogram captures the difference between the MACD line and its signal line, highlighting moments when downward pressure diminishes and upward momentum begins to build. The strategy aims to engage positions as momentum transitions from negative to positive territory, signaling the potential start of an upward trend.

The approach emphasizes early participation in emerging bullish phases rather than chasing extended moves. Risk management is incorporated conceptually through predefined stop-loss and take-profit considerations, allowing the strategy to limit potential losses while providing room to capture favorable price action. Overall, this methodology reflects a disciplined, momentum-driven framework that prioritizes timely signal recognition, controlled exposure, and professional execution aligned with strengthening market conditions.