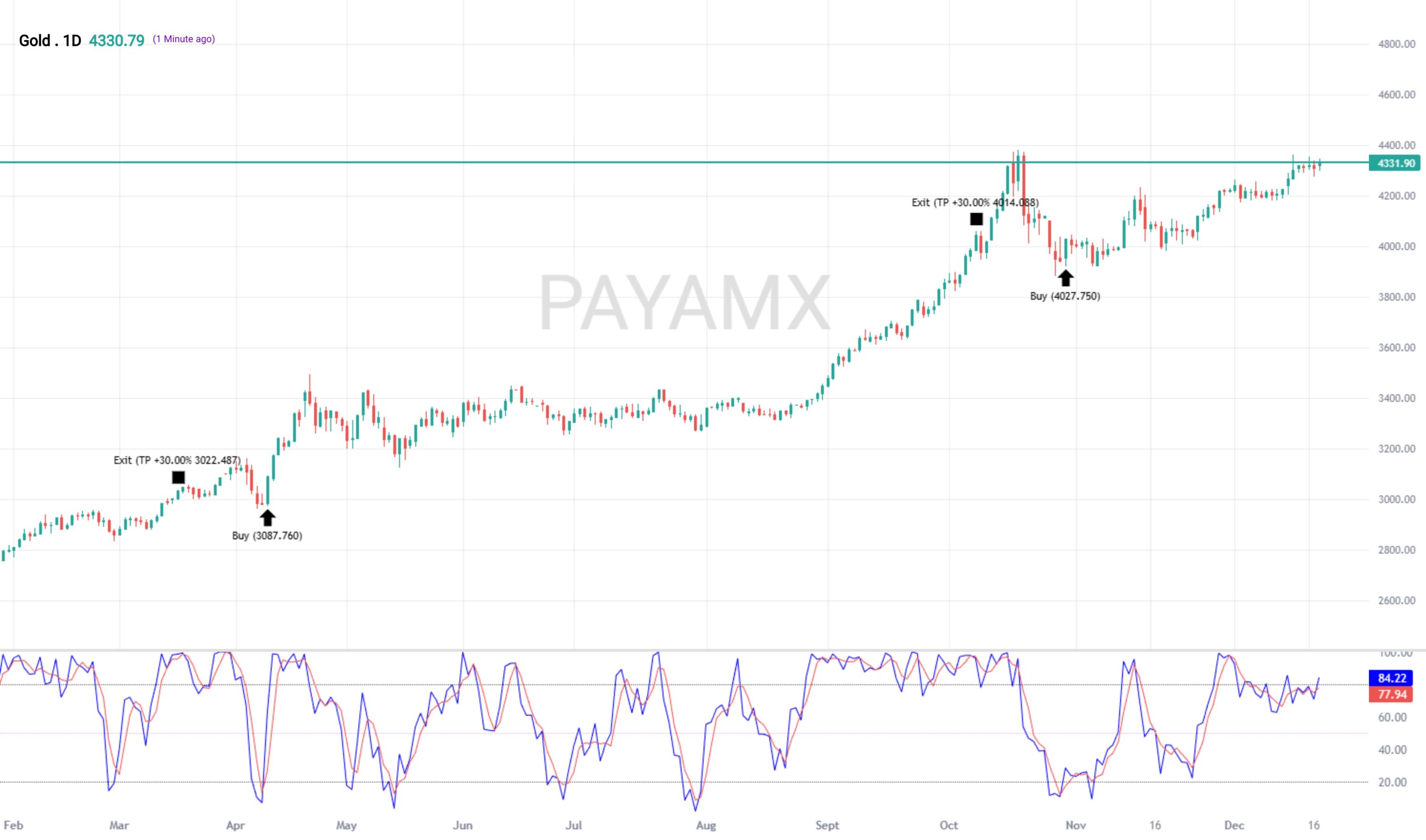

This PayamX long-only strategy is built around momentum oscillation analysis using the Stochastic indicator to identify potential bullish reversals. Conceptually, the indicator is used to evaluate the position of price momentum relative to its recent range, helping to highlight moments when selling pressure begins to fade and buying interest may start to emerge. The strategy focuses on detecting transitions from weaker momentum conditions toward strengthening upward movement.

The overall approach emphasizes early participation in recovery phases rather than chasing mature trends. Risk management is incorporated conceptually through predefined stop-loss and take-profit principles, allowing downside exposure to be controlled while giving favorable price action room to develop. This strategy reflects a disciplined momentum-based framework, designed to capture improving market conditions with structured risk awareness and professional execution.